rhode island property tax rates 2020

3182 combination commercial I. The rate threshold is the point at which the marginal estate tax rate kicks in.

Omaha Property Taxes Explained 2022

After closing at 1601 for 2020 that rate climbed to 1642 the following year.

. That represents one of the larger increases for any municipality in Rhode Island. Little Compton has the lowest property tax rate in Rhode Island with a tax rate of 604 while Providence has the highest property tax rate in Rhode Island with a tax rate of 2456. FY2023 starts July 1 2022 and ends June 30 2023There was no increase in our tax rates from last year the tax rates remainResidential Real Estate - 1873Commercial.

The Rhode Island sales tax rate is 7 as of 2022 and no local sales tax is collected in addition to the RI state tax. Property in all other municipalities is assessed at 100. Real property not exempted must be taxed equally and uniformly at present-day.

41 rows West Warwick taxes real property at four distinct rates. The citys conduct of property taxation must not disregard Rhode Island constitutional regulations. 4 West Warwick - Real Property taxed at four different rates.

3470 apartments 6 units. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three. 2989 - two to.

RHODE ISLAND TAX RATE SCHEDULE 2020 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES Taxable Income line 7 Over 0 65250 148350 But not over Pay--of the amount over. Overall Rhode Island Tax Picture. The current tax rates and exemptions for real estate motor vehicle and tangible property.

FY 2021 Property Tax Cap. The average effective property tax rate in Rhode Island is the 10th-highest in the country though. 3405 apartments 6 units.

1372thousand of the assessed property value. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. Start filing your tax return now.

Rhode Island income taxes are in line with the national. State of Rhode Island Division of Municipal Finance Department of Revenue. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022.

1300 per thousand of the assessed property value. Rhode Island state income tax rate table for the 2020 - 2021. 1372thousand of the assessed property value.

1735 per thousand of the. Real and Personal Property in all other municipalities is assessed at 100. Real Tangible Tax Rate - 20211152 per 1000 Non-Sewer District1206 per 1000 Sewer DistrictMotor Vehicle Tax Rate - 20212967 per 1000 500 State Exemption and 4500.

How to Calculate 2020 Rhode Island State. 4 Real Property taxed at four different rates. Detailed Rhode Island state income tax rates and brackets are available on.

Minnesota Results For The 50 State Property Tax Comparison Study For Taxes Payable In 2019

Rhode Island House Approves Accelerated Phase Out Of Car Taxes For East Providence Residents City Of East Providence Ri

Map Of Rhode Island Property Tax Rates For All Towns

Once Again Property Tax Survey Puts New Hampshire Near The Top Nh Business Review

No Boat Taxes In Rhode Island Yes It S True Hogan Associates Real Estate Blog

Harris County Tx Property Tax Calculator Smartasset

Historical Rhode Island Tax Policy Information Ballotpedia

Property Taxes Urban Institute

Cities With The Highest Tax Rates Turbotax Tax Tips Videos

Rhode Island Sales Tax Rates By City County 2022

Property Taxes How Much Are They In Different States Across The Us

Rhode Island State Economic Profile Rich States Poor States

Property Tax Calculator Property Tax Guide Rethority

Property Taxes By State Embrace Higher Property Taxes

New York Property Tax Calculator 2020 Empire Center For Public Policy

Disabled Veteran Property Tax Exemptions By State And Disability Rating

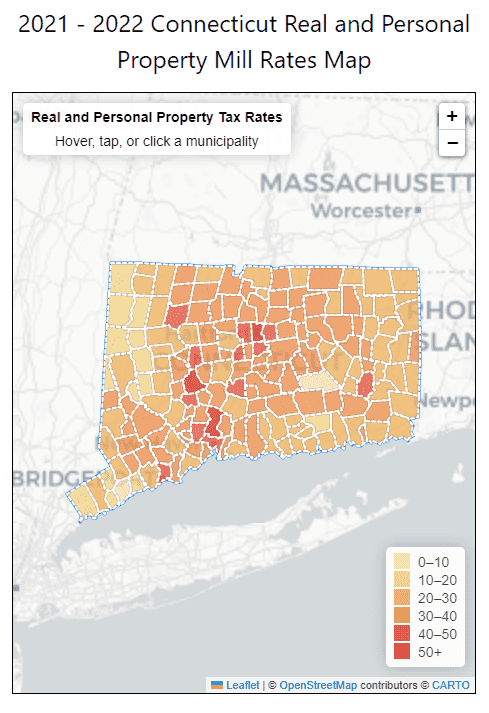

2021 2022 Fy Connecticut Mill Property Tax Rates By Town Ct Town Property Taxes

Tax Assessor City Of Pawtucket

Which U S States Charge Property Taxes For Cars Mansion Global